NDA’s Dhankhar Triumphs in Vice Presidential Election Amidst Hints of Cross-Voting In…

Bihar Deputy CM Links Nepal Unrest to Congress, Suggests India Merger for Peace

Bihar Deputy CM Links Nepal Unrest to Congress, Suggests India Merger for…

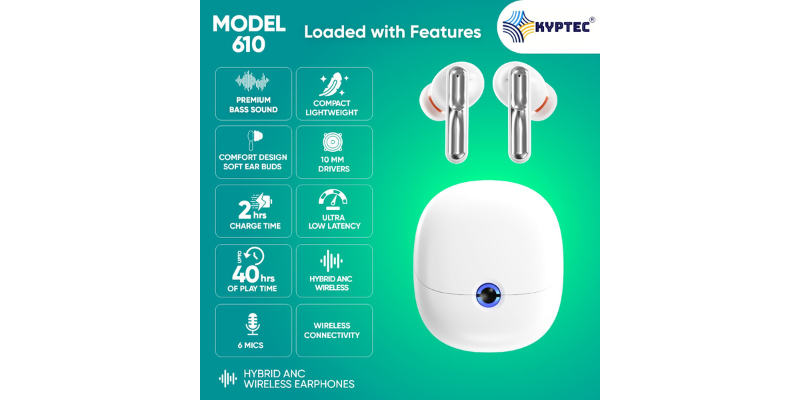

KYPTEC® 610 Hybrid ANC Wireless Ear Buds – Elevate Every Beat

Life never slows down, and neither should your sound. The KYPTEC® 610…

Congress MP Carried Through Floodwaters: Sparks Debate Over VIP Treatment

Congress MP Carried Through Floodwaters: Sparks Debate Over VIP Treatment A video…

Vice-President Election: BJD & BRS Choose Neutrality, Skip Voting; Opposition Conducts Mock Poll

BJD & BRS Sit Out Vice-President Election, Opposition Holds Mock Poll In…

TRAI Denies Blocking Election SMS: No Application Received, Says Service Provider Responsible

TRAI Denies Blocking Election SMS: Blames Service Provider, Not Election Commission The…

Vice Presidential Race Heats Up: NDA’s Strength vs. INDIA’s Ideological Stand

Vice Presidential Race Heats Up: NDA’s Strength vs. INDIA’s Ideological Stand The…

NDA’s Jagdeep Dhankhar Poised for Resounding Vice Presidential Victory

NDA Confident of Landslide Victory in Vice Presidential Election The National Democratic…

Flood-Ravaged Punjab & Himachal Appeal for Urgent Relief as PM Modi Visits

Flood-Ravaged Punjab & Himachal Appeal for Urgent Relief as PM Modi Visits…

India’s Next Vice President: Swearing-in Ceremony Set for September 12th

India’s Next Vice President to be Sworn in on September 12th India…